S&P 500 Stock History

A Century of Growth: The S&P 500’s Consistent Upward Trend

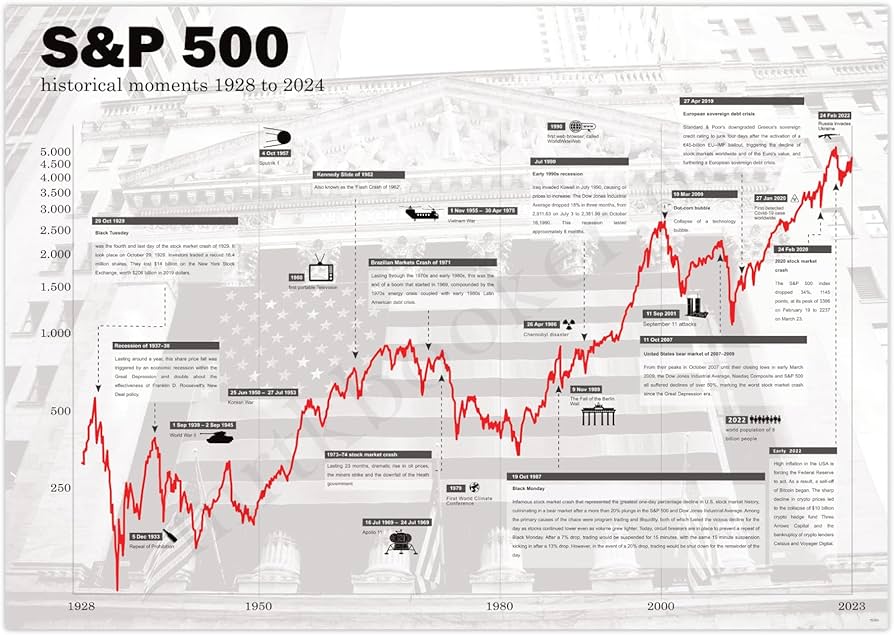

The Standard & Poor’s 500 (S&P 500) index, often considered a barometer of the U.S. stock market, has a storied history dating back to 1923. Since its inception, the index has consistently demonstrated a strong upward trend, making it a popular choice for investors seeking long-term growth.

A Brief History of the S&P 500

Originally comprising 233 companies, the S&P 500 was expanded to its current size of 500 in 1957. 1 This index tracks the performance of 500 large-cap U.S. companies, representing a diverse range of industries and sectors. 2 Over the decades, the index has weathered numerous economic downturns and market volatility, but it has consistently rebounded and continued its upward trajectory. 3

A Consistent Upward Trend

One of the most striking features of the S&P 500’s history is its long-term upward trend. While there have been periods of decline, particularly during economic recessions, the index has historically shown a remarkable ability to recover and continue its growth.

Historical Performance:

- Long-term average return: Over the past century, the S&P 500 has delivered an average annual return of approximately 10%. This figure, while not guaranteed, suggests a significant potential for long-term growth.

- Compounding effect: The power of compounding is a key driver of the S&P 500’s long-term performance. Over time, even modest returns can accumulate into substantial gains.

- Market cycles: The S&P 500 is subject to market cycles, which can include periods of both growth and decline. However, the long-term trend has been consistently upward.

Why the S&P 500 is a Safe and Low-Risk Investment

While past performance is not a guarantee of future results, the S&P 500’s historical track record suggests that it can be a relatively safe and low-risk investment. Here are some reasons why:

- Diversification: The index includes 500 companies, representing a wide range of industries and sectors. This diversification can help to mitigate the impact of individual company performance.

- Professional management: Many investors choose to invest in index funds that track the S&P 500. These funds are professionally managed, and they offer a convenient and cost-effective way to invest in the index.

- Long-term perspective: The S&P 500 is best suited for long-term investors who are willing to ride out short-term market fluctuations.

Conclusion

The S&P 500 has a long and successful history, characterized by a consistent upward trend and a strong potential for long-term growth. While past performance is not a guarantee of future results, the index’s track record makes it a compelling investment option for many investors.

Sources + Further Reading